White Collar Crime Review - Sept 17

Last week I started a White Collar Crime review as part of a class on white collar crime I am teaching, and here's an update on elite deviance, abuses of power, etc that's happened in the last week.

Before the review, a quick example of what Friedrich's Trusted Criminals book means by 'normal accident.' Remember that this is how human responsibility for the failure of complex systems becomes erased, so failures seem like 'normal accidents' (no one to blame here, move along). I mentioned the current financial crisis and Barry Ritholtz, who was chief investment strategist for an investment firm overseeing $5 billion in assets, highlights the following conclusions:

The current headache begins and ends with ideology, namely that of former Fed Chairman Alan Greenspan--an acolyte of Ayn Rand, a free-market absolutist, a true believer in the evils of regulation. Many of the present headaches point directly back to the decisions made by the Greenspan Fed. Sure, there is plenty of other blame to go around: an unengaged president, a clueless Congress, a hapless FDIC, a compromised OFHEO, and Phil Gramm--but the biggest and most accusatory finger points directly at Easy Al....

More background on Ritholtz - and see his discussion on "nonfeasance": "This wasn't mere Incompetence (doing a job poorly) or Malfeasance (commission of an unlawful act) -- this was Nonfeasance -- the Failure to perform an act that is either an official duty or a legal requirement."

A columnist on Bloomberg.com notes that the complexity not only "enable[s] the firms to hide the risks they run; it allows the people who make fortunes, while at the same time helping destroy vast amounts of capital, to remain essentially unknown to the wider public. In pointing to SEC Chairman Christopher Cox, the columnist notes:

the SEC has been morally bankrupt for some time now. The people who work for the place -- especially the ones who call the shots -- have for years had a disconcerting habit of leaving their low-paying government jobs regulating Wall Street firms for high-paying ones at those same Wall Street firms. They are meant to guard against systemic corruption when they are themselves systematically corrupt.

Also as follow-up: last week, I noted a question about severance pay for the CEOs of Fannie Mae and Freddie Mack. Footnoted.org reports that the govt will not contest the severance packages and explains that the contract for Fannie CEO Mudd,

like countless other CEO deals, says that the only way to dump him without his full severance package is a termination for “cause.” In Mudd’s case, as is common in CEOLand, ”cause” means dishonesty, willful misconduct, gross negligence or a felony conviction.

Some say Mr. Mudd has made rather a hash of things. But he’s not necessarily guilty of any of the above sins. CEOs negotiate for terms like “willful misconduct” and “gross negligence” because they set the behavior bar so low; generally speaking, you have to have bad intentions or show reckless disregard for the consequences of your actions. If you were merely incompetent, clueless, or inattentive, that’s usually not “cause.”

$85 Billion bailout of AIG - govt now owns largest insurance business

The New York Times reports the bailout of AIG this way:

The decision, only two weeks after the Treasury took over the federally chartered mortgage finance companies Fannie Mae and Freddie Mac, is the most radical intervention in private business in the central bank’s history...

If A.I.G. had collapsed — and been unable to pay all of its insurance claims — institutional investors around the world would have been instantly forced to reappraise the value of those securities, and that in turn would have reduced their own capital and the value of their own debt. Small investors, including anyone who owned money market funds with A.I.G. securities, could have been hurt, too. And some insurance policy holders were worried, even though they have some protections. “It would have been a chain reaction,” said Uwe Reinhardt, a professor of economics at Princeton University. “The spillover effects could have been incredible.”

Representative Barney Frank, Democrat of Massachusetts and chairman of the House Financial Services Committee, commented: “this is one more affirmation that the lack of regulation has caused serious problems. That the private market screwed itself up and they need the government to come help them unscrew it.”

The details of the plan:

Under the plan, the Fed will make a two-year loan to A.I.G. of up to $85 billion and, in return, will receive warrants that can be converted into common stock giving the government nearly 80 percent ownership of the insurer, if the existing shareholders approve. All of the company’s assets are being pledged to secure the loan. Existing stockholders have already seen the value of their stock drop more than 90 percent in the last year. Now they will suffer even more, although they will not be totally wiped out.

Since we've notes executive severance packages a few times: "Under the terms of his employment contract with A.I.G., Mr. Willumstad could receive an exit package worth as much as $8.7 million if his removal is determined to be “without cause,” according to an analysis by James F. Reda and Associates."

Brief overview of AIG Bailout/Takeover (Big Picture Blog)

Keep an eye on this: Some Seek [Govt] Agency to Buy Bad Debt as Long Term Answer (NYT). As with last week, part of the deeper question is 'socialism for the rich' (profits remain private; losses become everybody's responsibility) and new regulations put in place for firms that are 'too big to fail.' (see end of this week's entry for more on regulation)

Lehman Files for Record Bankruptcy, Victim of Meltdown Firm Helped Create

If that sounds harsh, that was the original headline to Bloomberg.com news story. They note:

The 158-year-old firm, which survived railroad bankruptcies of the 1800s, the Great Depression in the 1930s and the collapse of Long-Term Capital Management a decade ago, filed a Chapter 11 petition with U.S. Bankruptcy Court in Manhattan today. The collapse of Lehman, which employs about 25,000 people and listed more than $613 billion of debt, dwarfs WorldCom Inc.'s insolvency in 2002 and Drexel Burnham Lambert's failure in 1990.

Lehman was forced into bankruptcy after Barclays Plc and Bank of America Corp. abandoned takeover talks yesterday and the company lost 94 percent of its market value this year. Chief Executive Officer Richard Fuld, who turned the New York-based firm into the biggest underwriter of mortgage-backed securities at the top of the U.S. real estate market, joins his counterparts at Bear Stearns Cos., Merrill Lynch & Co. and more than 10 banks that couldn't survive this year's credit crunch.

Lehman paid $5.7 billion (yes, with a 'b') in bonuses last year. Will any of those be recoverable?

Sex, Drugs & Corruption at Interior Dept

From the Washington Post (Report Says Oil Agency Ran Amok - 11 Sept 2008, A1):

Government officials in charge of collecting billions of dollars worth of royalties from oil and gas companies accepted gifts, steered contracts to favored clients and engaged in drug use and illicit sex with employees of the energy firms, federal investigators reported yesterday.

The report from Inspector General Earl E. Devaney contains fresh allegations about the practices at the beleaguered royalty-in-kind program of Interior's Minerals Management Service, which last year collected more than $4 billion worth of oil and natural gas from companies given contracts to tap energy on federal and Indian lands and offshore.

The royalty-in-kind program, based near Denver, allows energy companies to pay the government in oil and gas, rather than cash, for the privilege of drilling on government land. It has been the subject of multiple investigations since 2006 by the Interior Department's secretary, its inspector general, the Justice Department and Congress for alleged mismanagement and conflicts of interest.

In the report released yesterday, investigators said they "discovered a culture of substance abuse and promiscuity" in which employees accepted gratuities "with prodigious frequency."

The royalty-in-kind program, which started as a small pilot project a decade ago, has been touted as a way to simplify the way oil and gas companies pay for the right to drill on federal land and offshore. Instead of calculating the profit from a well, they can simply give the government one-eighth to one-sixth of whatever they take from the ground.

Revenue rose quickly, from $1.5 billion in 2004 to $4.3 billion last fiscal year. But the growth occurred "in an environment with relatively unstructured in-house oversight," the congressionally convened Royalty Policy Committee said in a December report. Previous reports have said that companies were allowed to revise their million-dollar bids for projects indiscriminately, that government workers routinely failed to seek out legal advice on complicated deals and that the agency used outdated computers and a $150 million software program that resulted in royalty money going uncollected.

Former Interior Department auditors accused the agency of failing to bill companies. "We weren't allowed to audit them. It was kind of disturbing," said Bobby L. Maxwell, an auditor who sued the federal government for not collecting royalties. "You couldn't really see what was going on."

The New York Times also covered this story - Sex, Drug Use and Graft Cited in Interior Dept (11 Sept 08). From that story we can add a few other notes:

The Interior Dept's Inspector general noted in a cover letter to the report that there's “a culture of ethical failure” pervades the agency. The NYT characterized the report as portraying "a dysfunctional organization that has been riddled with conflicts of interest, unprofessional behavior and a free-for-all atmosphere for much of the Bush administration’s watch." And:

On one occasion, the report said, the royalty-in-kind program allowed a Chevron representative who had won a bid to purchase some of the government’s oil to pay taxpayers a lower amount than his winning offer because he said he had made a mistake in his calculations. A report from Mr. Devaney’s office earlier this year found that the program had frequently allowed companies that purchased the oil and gas to revise their bids downward after they won contracts. It documented 118 such occasions that cost taxpayers about $4.4 million in all.

Dept of Interior Inspector General has reports on Gregory Smith (a supervisor) and the Minerals Management Service (discussed above). The transmittal letter for both reports states: "I know you share my frustration with the length of time these investigations have taken, primarily due to the criminal nature of some of these allegations, protracted discussions with DOJ and the ultimate refusal of one major oil company - Chevron - to cooperate with our investigation."

Republicans: Lose Your Home, Lose Your Vote (MI, OH, elsewhere?)

As if it isn't bad enough to be foeclosed on and lose your home, Republicans then want to challenge your vote if you remain registered at the address of the foreclosed house. Certainly there is a legitimate voter fraud issue here - is the person living elsewhere and voting twice - but let's also be clear there's some problematic partisan politics also. The blog I read this on quoted the following from the original newspaper report:

The Macomb County party’s plans to challenge voters who have defaulted on their house payments is likely to disproportionately affect African-Americans who are overwhelmingly Democratic voters. More than 60 percent of all sub-prime loans — the most likely kind of loan to go into default — were made to African-Americans in Michigan, according to a report issued last year by the state’s Department of Labor and Economic Growth...

Credit Slips also covers this story and adds: "The leading foreclosure firm in the state seems to be a major supporter of the GOP's election efforts. That's a connection worth exploring--a law firm to file the foreclosures and a political party to challenge voters based on those same foreclosure filings."

Florida Farmworkers Exploited, Even Enslaved

From the Indiana Gazette (why no mainstream news coverage?)

Between each December and May, Florida grows nearly the entire U.S. crop of fresh field tomatoes for our homes, restaurants and supermarkets. Although the tomato is essential produce, most consumers do not know, or do not care, that many of the farm workers who harvest the crop are exploited and otherwise mistreated.

A federal case just ending in Fort Myers, in fact, shows that too many farm workers, especially tomato pickers, are being held as slaves. Five Immokalee field bosses, all relatives, pleaded guilty to several charges of enslaving Guatemalan and Mexican farm workers, forcing them to work and brutalizing them.

The 17-count indictment alleged that for two years, ringleaders Cesar Navarette and Geovanni Navarette kept more than a dozen men in boxes, shacks and trucks on their property. The workers were chained, beaten and forced to work on farms in North Carolina, South Carolina and Florida. Incredibly, the indictment shows that the men were forced to pay rent of $20 a week to sleep in a locked furniture van. They were forced to urinate and defecate in a corner of the vehicle.

To keep the workers obligated to them, the Navarettes devised drug, drink and food schemes to increase and guarantee the men's indebtedness.

[snip]

Farm workers are and always have been excluded from U.S. fair labor standards and are prevented from unionizing.

For more info, see the Coalition of Immokalee Workers.

Banks Helped Foreigners Escape US Taxes

The Washington Post reports (10 Sept 2008):

Big Wall Street investment banks have designed and marketed schemes enabling non-U.S. taxpayers, including offshore hedge funds, to evade millions of dollars in taxes each year on U.S. stock dividends, Senate investigators have found.

Some banks have been crafting for more than 10 years transactions designed to enable their foreign clients to dodge U.S. taxes on dividends, while the Internal Revenue Service failed to act to prevent the abuse, two senators say.

A yearlong investigation by a Senate Homeland Security and Governmental Affairs subcommittee, whose results are to be made public Thursday, found that the evasion of dividend taxes adds up to billions of dollars in revenue lost to the U.S. Treasury over the past decade.

[snip]

The inquiry is part of a series of hearings by the Senate panel on offshore tax abuse, which is estimated to cost the United States $100 billion a year in lost tax revenue.

SEC Enforcement and General Financial Regulation

A columnist for the New York Times, Floyd Norris, was curious to an SEC press release:

“The new tools the legislation provides will be a boon to the S.E.C. enforcement staff, which under Chairman Cox has increased to 34 percent of the S.E.C. work force from 32 percent in 2005 and 29 percent in the 1990s. This investment in investor protection already is paying significant dividends.”

Norris asks: "So Chris Cox has hired more investment staff, right? No. The staff is down on his watch." Turns out that the number of enforcement staff fell by 57, but the percentage is higher because the overall staffing at the SEC fell even more - or, as Norris puts it, "the enforcement staff has been cut less than other divisions."

He asks: "Is there anyone at the commission with the nerve to tell Mr. Cox that the enforcer of disclosure laws ought to be particularly careful to avoid misleading hype?"

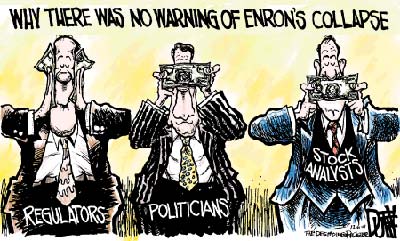

The presidential candidates are now talking about the problem, and not to be partisan, but I need to point out a Washington Post story, "McCain Embraces Regulation After Many Years of Opposition" (Sept 17, 2008, p A1). I point this out because a variety of politicians who pushed for deregulation were shocked (shocked!) about financial markets came to be deregulated enough to cause the accounting scandals starting with Enron. See Labaton, Stephen. 2002. “Now Who, Exactly Got Us Into This?: Enron? Arthur Andersen? Shocking Say Those Who Helped It Along” New York Times, February 3, p C01.

Does this seem familiar?

The McCain Embraces Regulation notes:

A decade ago, Sen. John McCain embraced legislation to broadly deregulate the banking and insurance industries, helping to sweep aside a thicket of rules established over decades in favor of a less restricted financial marketplace that proponents said would result in greater economic growth.

Now, as the Bush administration scrambles to prevent the collapse of the American International Group (AIG), the nation's largest insurance company, and stabilize a tumultuous Wall Street, the Republican presidential nominee is scrambling to recast himself as a champion of regulation to end "reckless conduct, corruption and unbridled greed" on Wall Street.

In 1999,

McCain had joined with other Republicans to push through landmark legislation sponsored by then-Sen. Phil Gramm (Tex.), who is now an economic adviser to his campaign. The Gramm-Leach-Bliley Act aimed to make the country's financial institutions competitive by removing the Depression-era walls between banking, investment and insurance companies.

That bill allowed AIG to participate in the gold rush of a rapidly expanding global banking and investment market. But the legislation also helped pave the way for companies such as AIG and Lehman Brothers to become behemoths laden with bad loans and investments.

McCain now condemns the executives at those companies for pursuing the ambitions that the Gramm-Leach-Bliley Act made possible, saying that "in an endless quest for easy money, they dreamed up investment schemes that they themselves don't even understand."

A bit more history:

McCain has not always opposed government regulation. He supported efforts to allow the Food and Drug Administration to regulate tobacco. And he pushed to strengthen the Sarbanes-Oxley Act requirements, which were put in place after the accounting scandals involving Enron and other major firms.

But he has usually reverted to the role of an unabashed deregulator. In 2007, he told a group of bloggers on a conference call that he regretted his vote on the Sarbanes-Oxley bill, which has been castigated by many executives as too heavy-handed. In the 1990s, he backed an unsuccessful effort to create a moratorium on all new government regulation

Obama has been vague on what to do, and McCain has discussed "new rules for fairness and honesty." The Post notes:

He did not describe how he would bring greater transparency to the process. His senior policy adviser, Douglas Holtz-Eakin, told reporters earlier in the day that there was no need for McCain to be specific right now. "There's no magic solutions, and I don't think it's imperative at this moment to write down what the plan should be," he said. "The real issue here is a leadership issue.''

I'd disagree - if there ever was a time to put forward good, specific ideas, it's now. For those interested, there's a 5 minute video interview that discusses some of the problems with deregulation and has a few ideas about what to do moving forward.

« White Collar Crime Review - Sept 10 | Main | White Collar Crime Review - Sept 24 »